When you're looking for a crypto exchange in Thailand, you don't just want another platform that says it’s secure. You want one that actually works with your bank, doesn’t crash when you try to verify your ID, and doesn’t lock your funds for months. That’s where Bitazza comes in - and why it’s one of the few exchanges in Thailand that actually has a license from the Thai SEC.

What Bitazza Actually Offers

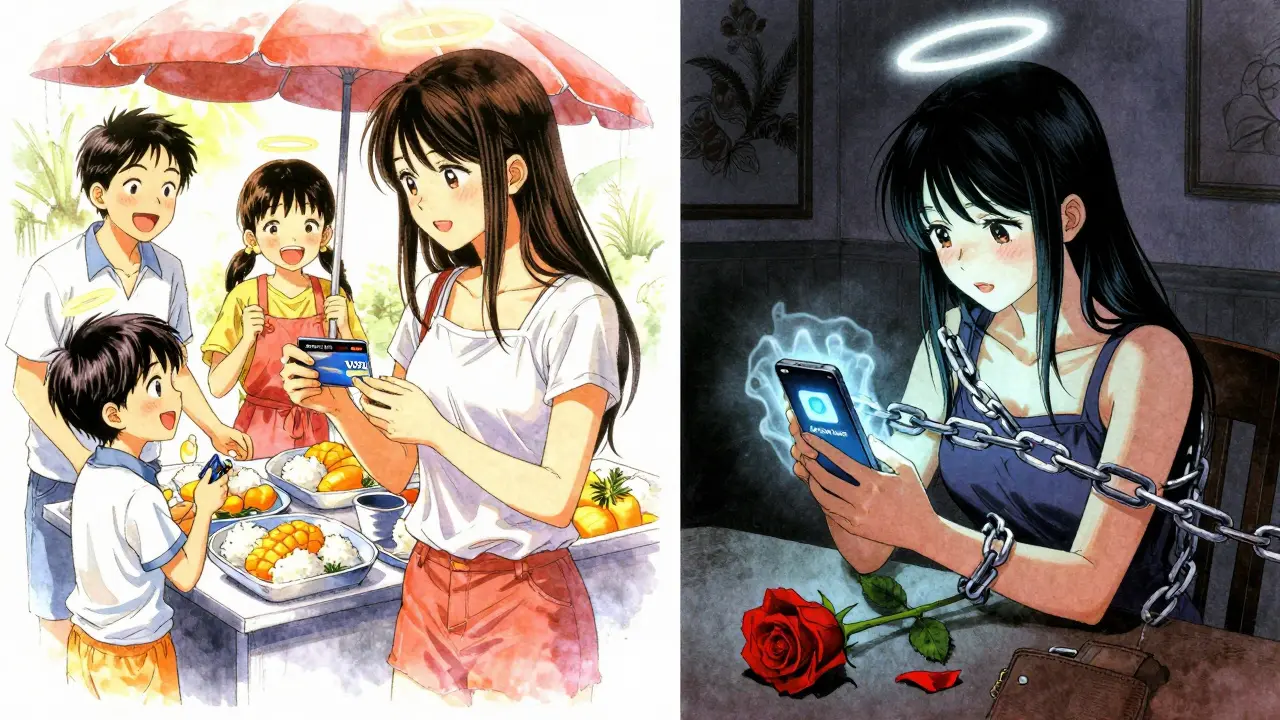

Bitazza isn’t trying to be Binance. It doesn’t have 500+ coins or copy trading or advanced derivatives. What it does have is something most global exchanges don’t: full compliance with Thailand’s Digital Asset Act. That means if something goes wrong, you have legal recourse - not just a support ticket that never gets answered. The platform supports over 90 cryptocurrencies, including Bitcoin, Ethereum, Solana, and popular Thai favorites like CAKE and SHIB. You can trade them against USDT or Thai Baht (THB). There are 190 trading pairs in the USDT market, which is enough for most retail traders. But if you’re chasing obscure tokens or altcoins from obscure projects, you’ll hit a wall fast. One of its standout features is the Bitazza Visa card, launched in late 2024. You can spend your crypto directly in stores or online, and it converts to THB automatically. For Thai users who want to use crypto like cash, this is one of the few real-world use cases that actually works.Fees and Deposit Limits - The Hidden Catch

Trading fees are standard: 0.15% for makers, 0.25% for takers. That’s competitive. But here’s the problem: if you want to deposit or withdraw Thai Baht, you need to move at least $30,000 in a single transaction. That’s not a typo. For most people, that’s more than their annual salary. This restriction makes Bitazza useless for casual traders. If you want to buy $100 worth of Bitcoin, you can’t do it with THB. You have to first buy USDT from another exchange, then transfer it over. That adds cost, time, and risk. It’s a major design flaw that only makes sense if Bitazza is targeting high-net-worth individuals or small businesses - not everyday users. Crypto deposits are free, which is good. But withdrawals? They’re free too - unless you’re hitting the daily limits tied to your KYC level.KYC and Security: Regulated, But Not Perfect

Bitazza requires full KYC. No exceptions. You need your Thai ID card, a selfie, and sometimes a proof of address. The process usually takes 24 to 48 hours. That’s faster than most global exchanges, but the app crashes constantly during document uploads. Multiple users on Reddit and Google Play have reported the same issue: the app freezes when you try to take a photo of your ID. You have to restart the app, try again, and hope it works this time. Once verified, your withdrawal limits depend on your KYC tier:- Level 1: $90,000 per day

- Level 2: $900,000 per day

- Level 3: Unlimited

Mobile App and User Experience

The Bitazza app has over 3 million downloads on Google Play and a 3.9-star rating. Sounds good, right? But read the reviews. The top complaints aren’t about fees or coins. They’re about crashes, failed KYC, and frozen accounts. The interface is clean and simple. Charts are basic - no TradingView integration. If you’re a day trader who needs indicators, volume profiles, or drawing tools, you’ll be frustrated. But if you’re just buying Bitcoin and holding, it’s fine. Customer support responds in Thai within 12-24 hours for simple questions. For complex issues - like a frozen account or failed withdrawal - you’re looking at 48+ hours. And if you don’t speak Thai? Good luck. The support team doesn’t offer English help.How Bitazza Compares to Other Thai Exchanges

In Thailand, Bitazza competes with Satang Pro and Zipmex. All three are Thai SEC-licensed. But here’s how they stack up:| Feature | Bitazza | Satang Pro | Zipmex |

|---|---|---|---|

| Thai SEC License | Yes | Yes | Yes |

| Min. Fiat Deposit | $30,000 | $10 | $10 |

| Supported Coins | 90+ | 60+ | 50+ |

| THB Trading Pairs | Yes | Yes | Yes |

| Visa Card | Yes | No | No |

| Mobile App Rating | 3.9/5 | 4.3/5 | 4.1/5 |

| English Support | No | Yes | Yes |

Who Should Use Bitazza?

Bitazza isn’t for everyone. It’s not even for most crypto users in Thailand. Use Bitazza if:- You’re a Thai resident with over $30,000 to move in a single transaction

- You want to spend crypto directly with a Visa card

- You value Thai SEC regulation over global brand names

- You’re a small business using crypto for payments

- You want to deposit $50 or $500 in THB

- You need English customer support

- You’re an active trader who needs advanced charts

- You’ve had bad experiences with app crashes before

The Big Question: Is Bitazza Safe?

Yes - and no. It’s safe in the sense that it’s regulated. The Thai SEC audits it. It’s not a fly-by-night operation. That’s more than you can say for 90% of exchanges operating in Southeast Asia. But it’s not safe in the way global users expect. No insurance. No multi-jurisdictional oversight. No 24/7 global support. And the app’s instability during KYC is a red flag for reliability. Security experts agree: Bitazza is a moderate-risk platform. It’s fine for holding Bitcoin or Ethereum, but don’t keep your life savings there. Spread your assets. Use it for trading, not storage.What’s Next for Bitazza?

Bitazza announced plans in late 2024 to expand into tokenizing real-world assets - think property, invoices, or small business loans - and to improve its OTC desk for institutional clients. If they pull that off, they could become a serious player in Thailand’s fintech space. But for now, they’re stuck in a narrow lane. They’re not big enough to compete globally. And they’re too restrictive for most local users. The future of crypto in Thailand isn’t about having the most coins. It’s about having the most trustworthy, user-friendly platforms. Bitazza has the license. But until they fix their app, lower the fiat deposit minimum, and offer real customer service - they’re just another exchange with a good compliance badge.Is Bitazza regulated in Thailand?

Yes. Bitazza is licensed and regulated by the Securities and Exchange Commission of Thailand (Thai SEC). This makes it one of the few crypto exchanges in the country with official government oversight, unlike unregulated international platforms operating in Thailand.

Can I deposit Thai Baht (THB) on Bitazza with less than $30,000?

No. Bitazza requires a minimum of $30,000 for any fiat deposit or withdrawal in Thai Baht. This makes it impractical for most retail users. To trade with smaller amounts, you must first buy USDT on another exchange and transfer it to Bitazza.

Does Bitazza have an English-language support team?

No. Bitazza’s customer support operates primarily in Thai. There is no official English support channel. Non-Thai speakers may struggle to resolve issues, especially during KYC problems or account freezes.

Is the Bitazza mobile app reliable?

The app has mixed reviews. While it has over 3 million downloads and a 3.9-star rating, many users report frequent crashes during document uploads and KYC verification. Some have been locked out of their accounts for weeks due to app failures. It’s functional for basic trading, but unreliable for critical tasks.

How does Bitazza compare to Satang Pro or Zipmex?

Satang Pro and Zipmex are better for most Thai users. They allow small THB deposits ($10+), have better mobile apps, offer English support, and are more user-friendly. Bitazza’s only advantages are its higher coin selection and its Visa card - but these don’t outweigh the access barriers for casual traders.

Can I use Bitazza outside of Thailand?

Technically yes - you can sign up from anywhere. But you won’t be able to deposit or withdraw Thai Baht unless you’re in Thailand with a local bank account. The platform is designed for Thai residents and offers no fiat on-ramps for other currencies.

Does Bitazza offer staking or earn products?

No. Bitazza currently does not offer staking, savings accounts, or yield products. It’s strictly a spot trading and OTC platform. If you want to earn interest on your crypto, you’ll need to use another service.

Patricia Amarante

I just tried signing up and the app crashed twice while uploading my ID. So much for 'regulated' if the app can't handle basic KYC.

Mark Cook

LOL they think $30k is a minimum? 🤡 I deposit $20 on Satang and it works fine. This is why crypto stays niche.

Tom Joyner

If you're not a whale, you're not worthy. Bitazza clearly targets oligarchs, not peasants. The Visa card is the only thing keeping it from being a total joke.

Dionne Wilkinson

I get why they did the $30k minimum. It filters out the noise. But it also filters out everyone who actually needs crypto to protect their savings from inflation. That’s not strategy - that’s exclusion.

Rebecca Kotnik

The regulatory license is meaningful, but only if the platform serves the public interest. When you gatekeep access behind a six-figure threshold, you're not building financial inclusion - you're building a private club with a blockchain logo. Regulation without accessibility is performative.

Donna Goines

They’re not just restricting deposits - they’re setting up a trap. Once you get in with $30k, they freeze your account for 'anomaly detection' and vanish for weeks. I’ve seen it happen three times. This isn’t compliance. It’s control.

Emma Sherwood

I’m Thai-American and I tried Bitazza last year. The lack of English support made me feel like I was doing something wrong just for not speaking Thai. It’s not just inconvenient - it’s alienating. You can’t claim to serve Thai users if you shut out half the diaspora.

Shruti Sinha

I use Bitazza for OTC trades. The platform is stable when you’re not doing KYC. The Visa card works great for paying local vendors. But yeah - don’t try to deposit $100. It’s not designed for that.

Madhavi Shyam

The $30k threshold is a liquidity filter. Institutional players need bulk onboarding. Retail is a liability. Bitazza’s architecture is built for institutional-grade risk management, not your $50 weekend trade.

Timothy Slazyk

It’s funny how people act like regulation is a guarantee of safety. The Thai SEC doesn’t audit their server logs. They don’t inspect their API endpoints. They just check if the paperwork is signed. That’s not security - that’s paperwork theater.

Kelsey Stephens

I get that Bitazza’s not for everyone. But if you’re a Thai small business owner who needs to pay suppliers in crypto and get paid in THB? The Visa card is the only thing that actually works. Don’t hate the tool because it doesn’t fit your use case.

Sean Kerr

app crashes during kyc?? bro i had to restart my phone 5 times 😭 i just wanted to buy 50 bucks of btc... why does this feel like fighting a robot?

Bradley Cassidy

I used to think Bitazza was the real deal until my account got frozen for 'unusual activity' after I bought SHIB. No email. No call. Just silence. Meanwhile, Satang Pro answered me in 4 hours. Guess which one I use now?

Sue Bumgarner

You people are acting like this is some kind of injustice. The US has $10k reporting thresholds. Europe has MiCA. Thailand’s trying to build a system that doesn’t get wiped out by a wave of pump-and-dumps. If you can’t handle $30k minimums, maybe you shouldn’t be trading crypto at all.

Samantha West

The absence of English support is not merely an oversight - it is a systemic rejection of multilingual accessibility in a globalized financial ecosystem. This constitutes a violation of the fundamental principle of equitable access to financial infrastructure, particularly within a nation that hosts a significant expatriate population.

Jesse Messiah

I used Bitazza for a few months. The card is legit - I bought coffee with ETH last week. But yeah, if you’re not rich or a business, just stick with Satang. No point in fighting the app every time you want to check your balance.

Greg Knapp

I tried to withdraw 10k usdt and got locked out for 11 days. They never told me why. I think they just wanted me to give up. I did. Now I use binance p2p. No drama

Cheyenne Cotter

Honestly, I think Bitazza’s model is kind of genius if you think about it. They’re not trying to be the biggest exchange - they’re trying to be the most secure, regulated, and compliant one in Thailand. That means excluding people who don’t meet their standards. It’s not about being user-friendly - it’s about being bulletproof. And honestly? That’s what we need in a country where scams are everywhere. The $30k minimum? It’s a filter. The app crashes? Probably because they’re prioritizing security over UX. The lack of English? They’re not trying to attract tourists - they’re trying to protect Thai citizens from global crypto chaos. I get why people hate it. But I also get why it exists.

Craig Nikonov

The Thai SEC license is a front. They’re in bed with the banks. That $30k minimum? It’s not about risk - it’s about keeping retail out so the banks can control the flow. And the Visa card? It’s a Trojan horse to bring crypto into the traditional system - where they can track every transaction. This isn’t freedom. It’s surveillance with a blockchain sticker.

Heather Turnbow

I appreciate the effort to regulate. But regulation without empathy is just bureaucracy. If you want to protect Thai users, you need to make the platform work for them - not just for those who can afford a luxury car.

SeTSUnA Kevin

The $30,000 minimum is not a flaw - it is a deliberate design choice to align with institutional-grade liquidity requirements. Retail users are statistically more likely to trigger compliance flags. This is not exclusion; it is risk mitigation.

Dionne Wilkinson

I think the real question isn't whether Bitazza is safe - it's whether safety should come at the cost of access. If crypto is supposed to be for everyone, then locking out 95% of users behind a wall of cash doesn't make it more secure. It just makes it less human.

Elvis Lam

The Visa card is the only reason this platform has any real-world utility. I use it to pay my Thai staff in crypto and get THB back instantly. No more forex delays. No more fees. It’s not perfect, but it’s the only thing in Thailand that actually makes crypto feel useful. The rest is just noise.